By Rick Patelunas

U.S. Rep. Tom Rice (R-SC) echoes the Trump Administration’s mantra that the 2018 economy was stronger than ever. Republican tax cuts and deregulation are supposedly unleashing a growing economy. To paraphrase from Rice’s taxpayer financed “District Update,” let’s look at results vs. the rhetoric.

Nationally, the Gross Domestic Product (GDP) grew at 2.9 percent in 2018, far below Trump’s projections of 4, 5 and 6 percent. Trump’s Council of Economic advisors explained that without the stimulus provided by the Republican tax cut, 2018 would have been a continuation of the trend started under President Obama.

While the stimulus was good while it lasted, calling it a sugar high is not a bad description. The momentum of the tax cut is fading as many economists, including the President’s Council of Economic Advisors, are calling for slower growth and higher unemployment over the next few years.

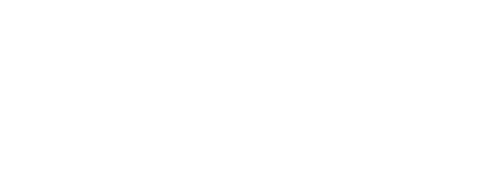

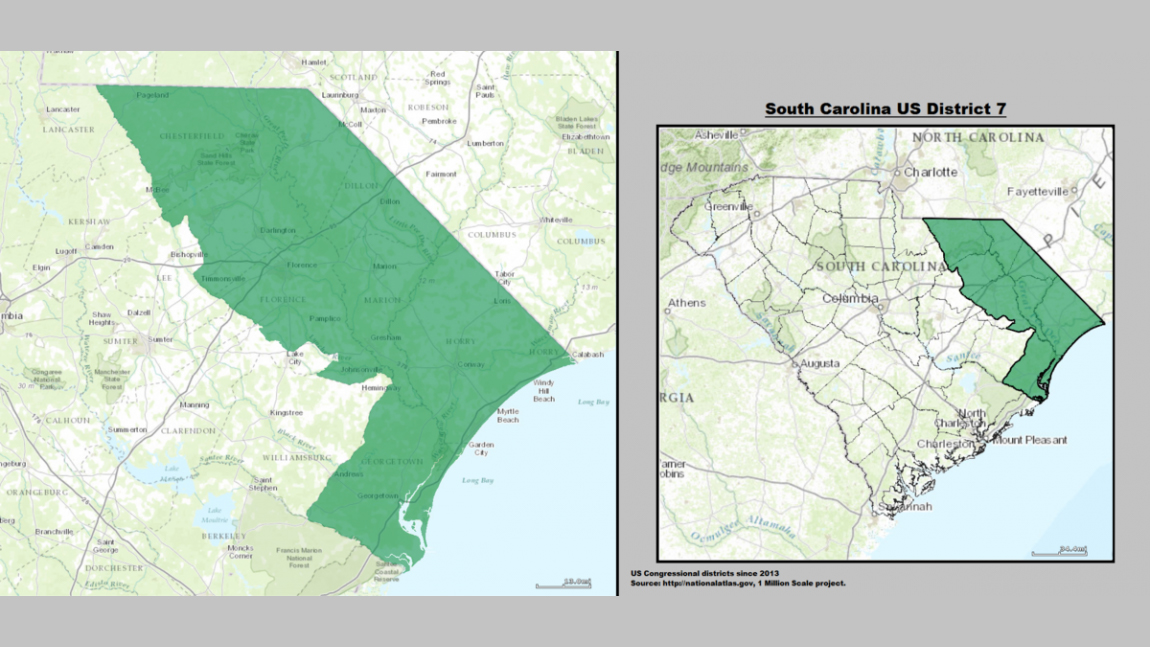

The 2018 economy in Rice’s 7th District was likewise over-hyped.

The Congressman campaigned on jobs, jobs, jobs and his District Update states: “Unemployment rates in Marion and Marlboro counties have been cut in half over the last two years.”

The Employers Association of South Carolina (EASC) provides monthly unemployment data for each South Carolina county, so for consistency to compare across the state, the EASC unemployment rates are used. The state unemployment rate stood at 3.3 percent in December 2018 and of the eight counties that make up the 7th District, only one, Chesterfield at 3.3 percent, was not above the statewide average.

Five of the top 11 counties with the highest unemployment rates are in the 7th District. Although improved, Marion county finished 2018 at 5.6 percent unemployment, the third highest in the state, and Marlboro county was at 4.8 percent, the seventh highest in the state.

The poor 2018 results for the 7th District are not much different from when Rice was first elected. There has been improvement, but there was more improvement nationally and across the state.

Without the Republican tax cut, Trump can only claim credit for not destroying the trend begun by Obama. Similarly, it would be hard for Rice to claim much credit for the District results. The reasonable explanation for the improvement in the 7th District is that it rode the coattails of national and state trends.

Rice fancies himself a fiscal conservative and he praised Trump’s call for budget cuts in his most recent District update:

On Monday, President Trump released his budget request which puts the next generation of American taxpayers first through responsible cuts to mandatory spending programs. His budget request prioritizes effective spending that will move our country forward and cuts bloated government programs that are driving our debt.

Note the comment that bloated government programs are driving our debt. Such is a usual conservative talking point, but it is not correct. The Congressional Budget Office reports that:

CBO projected that the tax cut will add $1.9 trillion to deficits over 10 years, even after accounting for any growth effects. We are already seeing this play out. The deficit grew 17 percent last year and is projected to grow another 15 percent this year even as the economy grew faster. The idea that tax cuts for the wealthy and corporations would allow us to grow our way out of debt – one of Republicans’ favorite myths – has proven incorrect once again.

Read more about what the CBO says about the budget and economy here.

The reality is that the tax cut ballooned the deficit, shifted money to the wealthy, resulted in corporate buybacks to inflate stock values and had little lasting impact on the working class.

Hurting District Residents

Nevertheless, Rice wants to use the deficit to do further damage to the not so wealthy by supporting Trump’s proposed 2020 budget. Trump’s proposes cutting $2.5 trillion from Medicaid, Medicare, Social Security and many of the other programs designed to help those in need when many in Rice’s district are the ones in need.

Take the $25 billion to cuts to Social Security over the next 10 years as an example. As of December 2017 (the last data available from the Social Security Administration), there were 196,220 Social Security recipients in the 7th District, 139,205 who were over 65 years old. With an estimated population of 720,000, a little over one-in-four District residents receive Social Security benefits. It’s hard to see how cutting those benefits does anything other than hurt nearly 200,000 of Rice’s constituents.

The results don’t support Rice’s rhetoric. Instead of hurting the people of the 7th District to demonstrate that he is fiscally conservative, Rice might want to rethink his position on the Republican tax cut.

Blaming government programs for the deficit while ignoring the tax cut is morally wrong and financially bankrupt. Much more needs to be done for the people of the 7th District.

It’s time for the wealthy to pay their fair share and to expand programs that help the elderly, the disabled, the unemployed – in other words, those most in need in the 7th District of South Carolina.

Rick Patelunas has been active in the Horry County Democratic Party since moving to Myrtle Beach in 2012. He is a member of the Southenders club, served as Precinct President, been a delegate to State conventions and worked on a number of campaigns.