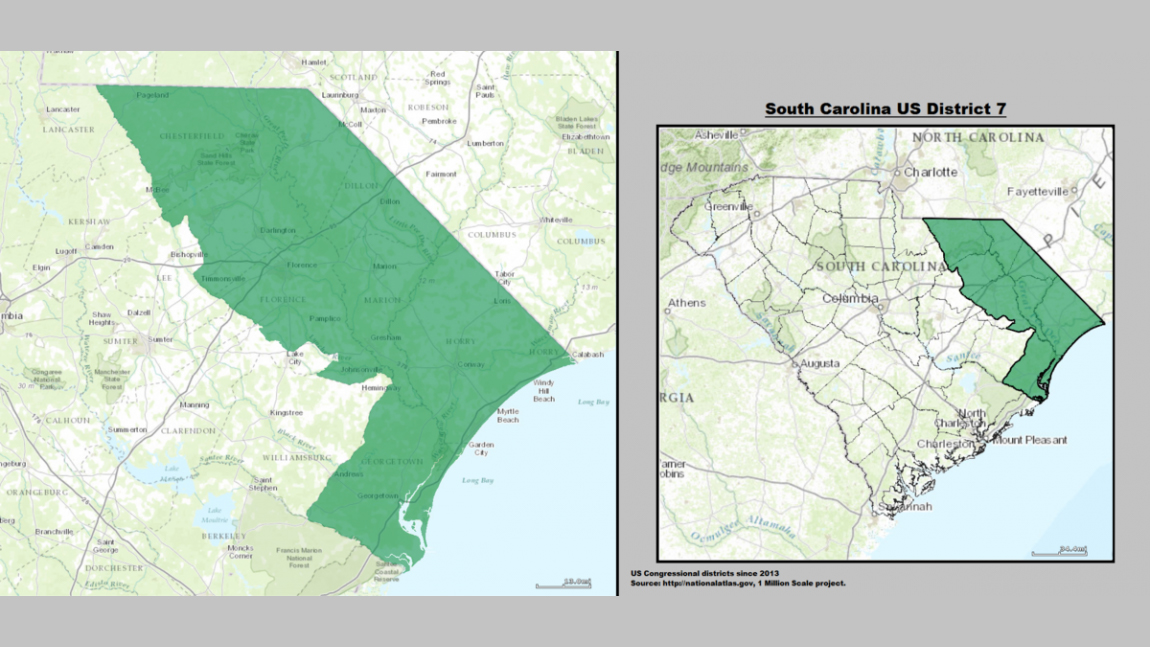

Editor’s Note: This is the first of an ongoing series of social movement profiles by Dr. Jeremy Holland, who teaches sociology at Horry Georgetown Technical College. In this series, he will introduce contemporary American social movement groups focused on economic redistribution, identity equality, and public safety.

By Dr. Jeremy Holland

Millions of college students across the nation, including right here in South Carolina, are buried in student loan debt – debt that forces many to leave school and that will take years to repay. While President Biden has extended the current Covid-19-related freeze on student loan payments until January 31, there is a concerted effort underway to provide a permanent solution that would end this onerous burden on students and allow them to embrace their future careers unencumbered.

The initiative is being led by the Debt Collective, which recognizes two simple financial truths. First, all American debt, including student loan debt, is someone else’s profit. Second, if debtors come together and participate in economic resistance to the debt system, then they can turn indebtedness into a form of leverage over government agencies and private companies who mean to extract the money.

The main issue being addressed by the Debt Collective is that tens of millions of Americans are carrying more than $1.7 trillion in student debt. Currently, one million people default every year on their student loan repayments. The Debt Collective’s solution is to mobilize a mass movement that will pressure the current administration to use its power to cancel student debt, either by legislation or executive action.

To wipe all student loan debt away in an instant may seem like a utopian dream, but Congress has already granted the President and the Secretary of Education the authority to cancel all federal student debt through what is known as the “Compromise and Settlement” authority. So, the question is not whether cancelling student debt is possible, but whether the president will come to see this act as economically sound and morally just.

Further, the Debt Collective is committed to seeing Congress pass the College for All Act so that in the future public college is tuition free and students are not leaving colleges burdened by massive debts. In our information society, for most American working and middle-class youths, education is a necessary steppingstone to finding lucrative employment opportunities.

Origins of the Debt Collective?

After the 2008 mortgage debacle and the ensuing global financial meltdown, the banks that created and propagated questionable loan schemes to the American middle and lower classes were bailed out by the government.

At the same time, first time home buyers lost their homes, retirees saw their retirement accounts dwindle in value, and college graduates attempted to enter the workforce as temporary or contract workers with little prospect of attaining a well-paid career position. Sadly, because of predatory sub-prime mortgage loans, between 2006 and 2013 nearly 14 million homes entered the foreclosure process, and more than 9 million American households lost their homes.

In the midst of this colossal economic bust emerged the Occupy Wall Street Movement. It happened in 2011 when a group of activists began drawing attention to increasing economic inequality, corporate greed, and the influence that corporations have on the U.S. system of government. The movement was a mixture of left-wing groups ranging from liberal democrats to social anarchists.

After the dissolution of Occupy Wall Street, a few activists sought a way to continue organizing around wealth and income distribution to further the cause of economic justice for the American people. By 2014, alumni from this organizing work started the Debt Collective as a project to free student debtors from a dismal financial future.

What is the problem?

The reality for most American college graduates is that they leave our educational institutions in a giant financial hole, all before they ever attempt to cover the expenses of getting married, buying a home, and supporting children. Consider the fact that the average college student today graduates with $32,000 in debt. An uneven economy and high levels of student debt have created hurdles to financial security for many young adults. As a result, more young people are stuck living at home with their parents.

At the core the problem is public disinvestment or what is known as austerity politics. The myth of the debtor as an individual who made a bad choice obscures the reason that we are in debt. Medical debt doesn’t exist in countries with nationalized healthcare systems, and student debt is unheard of in parts of the world where public college is free. Disinvestment in the things people need to survive and thrive opens space for profit-hungry predators.

For the past few decades accumulating more and more debt has been the only solution to this impossible bind of low wages and lack of social services. In this sense, our nation has moved from being a welfare state to a “debtfare” state, with what should be publicly financed goods treated as individual debt obligations.

Part of the problem is that instead of taxing rich people and corporations, we borrow from them, paying them interest for the privilege. How did this happen? Within neoliberal capitalism, financialization is the specific mechanism that has resulted in so many of us drowning in debt. Financialization is when we are forced to borrow to access goods and services, such as medical care and higher education, that the government should guarantee for all.

What is the solution?

The Debt Collective argues that we must begin understanding that our out-of-control student debt is not a personal failure where we must drown alone, but that these debts are a systemic failure that unites us and moves us into a state of collective refusal. Individually, debts easily overwhelm us, but collectively they stand as a source of people power. To conduct this kind of mass politics, debtors must establish an institutional base. This is where debtors’ unions come into play.

The question has always been who would get to wield debt as a form of power—the wealthy or the working class? For the union to gain political power, its members must engage in campaigns of economic disobedience and threaten collective nonpayment. Debtor organizing has the potential to bring millions of people who may never have the option of joining a traditional labor union into the struggle for economic justice.

The Debt Collective holds the conviction that education, healthcare, housing, and retirement should be considered public goods, and that no one should have to go into debt to gain access these basic necessities. The group intends to use mass indebtedness as an organizing catalyst to mobilize a cross-class, multiracial coalition.

One way the group is already working toward this goal of economic justice is by making tools for disputing debt widely available to student borrowers online. With these tools, students can dispute any debt in collections, dispute errors on their credit report, dispute their wages being garnished by the government, dispute their tax return being taken, and dispute any fraud committed by questionable educational institutions.

What about the national economic impact?

What may at first seem counterintuitive, academic research demonstrates that eliminating student debt for everyone would provide a significant boost to the economy. A recent study by the Levy Institute finds that cancellation would have a meaningful stimulus effect, characterized by greater economic activity as measured by GDP and employment.

Specifically, debt abolition of student loans would boost the economy by approximately $100 billion a year for at least 10 years, yielding lower unemployment rates, increased spending, and more. This policy action would have only moderate effects on the federal budget deficit, interest rates, and inflation while state budgets improve.

What are the current policy proposals?

To remedy this situation of ever escalating American debt, the Debt Collective has written a proposed executive order to be signed by the President. The group makes the case that upon the signing this two-page document, 100 percent of all federal student loans will be abolished.

The proposed executive order directs the Department of Education to implement the “Compromise and Settlement Clause,” so carrying out this executive order would require little more than the secretary of education’s signature, which would then effectively cancel all obligations to repay federal student loans.

The Debt Collective also supports legislation entitled the College for All Act, which would eliminate tuition and fees at public four-year colleges and universities and makes community college tuition free for all.

This legislation would provide at least $41 billion per year to states. Students from any family making $125,000 or less—about 80 percent of our population—would be able to attend a public four-year college or university. The federal government would cover 67 percent of the cost of eliminating tuition and fees at public colleges and universities. States would be responsible for eliminating the remaining 33 percent.

The estimated $600 billion cost of this legislation would be paid for by a separate bill to tax Wall Street speculation. More than 1,000 economists have endorsed a tax on Wall Street speculation and some 40 countries have already imposed a similar financial transactions tax.

What are the Debt Collective’s successes and goals?

In 2015, 15 former students of a predatory, for-profit college chain called Corinthian launched the first student debt strike in history. The college had systematically defrauded its students, burying them in unpayable loans while funneling money to shareholders. Over the last five years, Debt Collective members succeeded in forcing the government to cancel more than a billion dollars’ worth of these student loans through a legal campaign around what is known as the “defense to repayment right.” This campaign has been instrumental in helping change federal regulations, making it possible, for the first time, for defrauded student borrowers to get their debt discharged.

As of summer 2021, around 1,500 Americans are already on strike, not paying their student loans. This means they are already in default or that they have enrolled in programs such as forbearance, deferment, or $0 income-based repayment to halt payments.

Debt Collective members are not advocating debt forgiveness, which implies a benevolent creditor taking pity on a blameworthy debtor, but rather a debt abolition and the creation of a new economic paradigm in which shared liberation is a socially financed project. The American public must band together in constructing a world where college is publicly funded, healthcare is universal, and housing is guaranteed.

About the Author: Dr. Jeremy Holland is sociology professor at Horry Georgetown Technical College and a member of the HCDP Communications Committee.